dimensionlink.online

News

Interest Rate On Cars

Auto Loan Interest Rates for + Model Year Vehicles · 36 Months, %, $ 48 Months, %, $ 60 Months, %, $ 72 Months, %. New and Used Car Loan Interest Rate by Credit Score ; , % · % ; , % · % ; , % · % ; , % · % ; , The average car loan interest rate in is around 4% for new cars and 8% for used cars based on the Experian data above. A good interest rate will be at or. New Auto Rates ; N/A, % – %, $ – $ ; $10,, % – %, $ – $ Auto Loan Rates as Low as % APR for New Vehicles You could get a decision in seconds, plus a discount for active duty and retired military. Whether you'. Rates accurate as of 08/24/ Rates are subject to change without notice. Vehicles model year and newer. Vehicles with mileage of , or greater, an. Fixed auto loan interest rates as low as % APR¹ with MyStyle® Checking discount; No application fees; Terms up to six years²; Onsite financing—tell the. Average interest rates for car loans. The average APR on a new-car loan with a month term was % in the first quarter of , according to the. Auto loan rates range from % APR to % APR and are subject to term, credit union relationship, and credit worthiness. Auto Loan Interest Rates for + Model Year Vehicles · 36 Months, %, $ 48 Months, %, $ 60 Months, %, $ 72 Months, %. New and Used Car Loan Interest Rate by Credit Score ; , % · % ; , % · % ; , % · % ; , % · % ; , The average car loan interest rate in is around 4% for new cars and 8% for used cars based on the Experian data above. A good interest rate will be at or. New Auto Rates ; N/A, % – %, $ – $ ; $10,, % – %, $ – $ Auto Loan Rates as Low as % APR for New Vehicles You could get a decision in seconds, plus a discount for active duty and retired military. Whether you'. Rates accurate as of 08/24/ Rates are subject to change without notice. Vehicles model year and newer. Vehicles with mileage of , or greater, an. Fixed auto loan interest rates as low as % APR¹ with MyStyle® Checking discount; No application fees; Terms up to six years²; Onsite financing—tell the. Average interest rates for car loans. The average APR on a new-car loan with a month term was % in the first quarter of , according to the. Auto loan rates range from % APR to % APR and are subject to term, credit union relationship, and credit worthiness.

Today's New & Used Car Loan Rates ; %, %, %, % ; %, %, %, N/A.

Auto loans carry simple interest costs, not compound interest. The borrower agrees to pay the money back plus a flat percentage of the amount borrowed. The. Average Auto Loan Rates for Excellent Credit ; Credit Score, New Car Loan, Used Car Loan ; or higher, %, %. Explore car loan rates ; New/Used Cars, and newer models, Up to 63 months, As low as % ; New/Used Cars, and newer models, 64 to 75 months, As low as. Get Discounted Interest Rates with Auto Pay Car loan APRs range from % APR to % APR when you use Auto Pay. Ready to. Compare auto loan rates in August ; Carvana, %%, months ; myAutoLoan, Starting at %, months ; Upstart, %%, months. ** The APR (Annual Percentage Rate) is based on credit worthiness, loan amount, current mileage, term of the loan and loan to value. A lower credit score may. One of the main factors lenders consider when you apply for a loan is your credit score. A higher score can help you secure a better interest rate—which means. Auto Loan Rates ; New Auto. %. $ % ; New Auto. %. $ %. That's why we're a leader in car financing wherever we have offices. Vehicle loan rates are updated frequently to bring you the best car interest rates possible. A good interest rate for an auto loan is subjective — it depends on your credit score, the car you're buying, the amount of your down payment and more. In the. Loan Amount: · $5k. $k ; Interest Rate: %. %. 8% ; Term: 45 Months. 6mo. 48mo. With dealer financing, the potential car buyer has fewer choices when it comes to interest rate shopping, though it's there for convenience for anyone who doesn. Auto loan interest is the extra cost in addition to your loan principal — your starting loan amount — that lenders charge you for borrowing money. Your interest. Apply for auto financing today. The rate calculator provides estimated auto financing terms, APRs and monthly payment amounts. Maximum APR is %. If you change your payment method to coupon at any time, your interest rate will increase by% Annual Percentage Rate (APR). PSECU. T) Payment per $1, balance is based on the interest rate listed with a maximum term. Example: for a 7 year (84 month), $20, new auto loan at the rate. July Car Loan Rates (APR) in the U.S. for Used and New Cars · 9% - % · 10% - % · 11% - % · >12%. AUTO LOAN RATES ; Up to 36 Months, $5,$,, % ; Months, $10,$,, % ; Months, $15,$,, % ; Months, $20,$. Your interest rate and monthly payments will depend on your credit, your income, and your vehicle preference. Interest rates on new vehicles are often lower.

Can I Remove A Collection From Credit Report

You can negotiate with debt collection agencies to remove negative information from your credit report. If you're negotiating with a collection agency on. Most service providers have a written policy about past-due accounts and will send your account to a collection agency after a certain time period—typically No, you cannot have the collection account removed from your report. (Unless you can somehow claim the account is fraudulent or invalidated. Section et seq., is the law that controls credit reporting agencies. The law states that credit reporting agencies may not report a bankruptcy case on a. This process is only available if the collection agency agrees to it. It is also important to note that even when collections are removed from your credit. Having collections removed from your credit report is tough. However, it is possible through writing a goodwill letter, disputing the collection, checking for. Whether your attempts to use pay for delete are successful can depend on whether you're dealing with the original creditor or a debt collection agency. "As to. Whether your attempts to use pay for delete are successful can depend on whether you're dealing with the original creditor or a debt collection agency. "As to. No, but it changes its status to “paid.” This looks better than an outstanding collection. How much does a collection impact my credit score? The impact varies. You can negotiate with debt collection agencies to remove negative information from your credit report. If you're negotiating with a collection agency on. Most service providers have a written policy about past-due accounts and will send your account to a collection agency after a certain time period—typically No, you cannot have the collection account removed from your report. (Unless you can somehow claim the account is fraudulent or invalidated. Section et seq., is the law that controls credit reporting agencies. The law states that credit reporting agencies may not report a bankruptcy case on a. This process is only available if the collection agency agrees to it. It is also important to note that even when collections are removed from your credit. Having collections removed from your credit report is tough. However, it is possible through writing a goodwill letter, disputing the collection, checking for. Whether your attempts to use pay for delete are successful can depend on whether you're dealing with the original creditor or a debt collection agency. "As to. Whether your attempts to use pay for delete are successful can depend on whether you're dealing with the original creditor or a debt collection agency. "As to. No, but it changes its status to “paid.” This looks better than an outstanding collection. How much does a collection impact my credit score? The impact varies.

If enough time passes following a late payment, the creditor may transfer your account to a collection agency or sell your debt to a third party. In this. Either the original creditor or the collection agency may report the account in collections to a credit bureau. The account will be marked on your credit report. collector removing the negative information from the debtor's credit report. This can be an effective way to improve your credit score, but it is important. How to remove collections from your credit report · Option 1: Dispute the account · Option 2: Send a pay for delete letter · Option 3: Request a goodwill deletion. Fortunately, you have different options for removing collections from your credit report. You can dispute them, negotiate with the collectors, or wait for them. Whether your attempts to use pay for delete are successful can depend on whether you're dealing with the original creditor or a debt collection agency. "As to. Inaccurate information like that could end up on your credit report and affect your ability to get credit, insurance, or even a job. If you think someone might. Even if you paid off a collections account, it will appear on your report for up to 7 years. An exception is medical debt, which is removed from your credit. If the information is incorrect or the collection account can't be verified, the credit bureau must remove it from your report. You'll have to deal with each. While you may be able to negotiate pay off amounts on your collections, the collections themselves will remain on your credit report for seven. Draft a dispute: Write a clear, concise dispute that you can send online to each credit bureau's dispute department at no cost to you (Equifax, Experian, and. A good first step is to contact the lender or creditor. You can also file a dispute with the credit bureau that furnished the report where the account is listed. Remember that paying off an old debt may not erase it from your credit history. Also, if you settle the debt, some collectors will report that on your credit. Either the original creditor or the collection agency may report the account in collections to a credit bureau. The account will be marked on your credit report. Having collections removed from your credit report is tough. However, it is possible through writing a goodwill letter, disputing the collection, checking for. Pay for delete refers to the process of getting a debt collector to remove collection account removed from your credit report. It's a point you can use during a. If it does make it onto your credit report, yet another form of dispute letter should be sent to the credit-reporting agency, disputing the accuracy of the. Contrary to what many consumers think, paying off an account that's gone to collections will not improve your credit score. The information provided on this. The credit bureaus are unlikely to remove the paid collection account if it was legitimately incurred. They will only remove an item from your credit report if. Even if you paid off a collections account, it will appear on your report for up to 7 years. An exception is medical debt, which is removed from your credit.

Best Etf Instead Of Savings Account

An FDIC-insured bank sweep and savings account alternative. $0 initial For more information about Vanguard mutual funds or Vanguard ETFs, obtain a mutual fund. Merrill offers access to a variety of money market mutual funds (money market funds) and bank deposit solutions designed. Opting for a broadly diversified portfolio of low-cost index funds and ETFs is the best way to reduce the costs of investing—including risk—while still. ETF - Exchange Traded Funds*. Like mutual funds, ETFs are also made of TFSA - Tax-Free Savings Account. The every-person investment account. Best. Instead of cash, consider an investment product like a mutual fund or an ETF. Mutual funds and ETFs offer a bundle of individual stocks or bonds in one purchase. Get the most out of cash savings with Purpose Investments High Interest Savings Fund. Generate best-in-class yields and access your cash anytime — Learn. If you're planning to make one of these purchases within the next three years, it's best to keep your money intact and accessible in a savings account, rather. Who Offers the ETFs? · Purpose High Interest Savings ETF (ticker: PSA). · Purpose US Cash Fund (ticker: PSU. · CI First Asset High Interest Savings ETF (ticker. Top Holdings · NATIONAL BANK CASH ACCT. % · SCOTIABANK CASH ACCOUNT. % · CIBC CASH ACCOUNT. % · CASH. %. An FDIC-insured bank sweep and savings account alternative. $0 initial For more information about Vanguard mutual funds or Vanguard ETFs, obtain a mutual fund. Merrill offers access to a variety of money market mutual funds (money market funds) and bank deposit solutions designed. Opting for a broadly diversified portfolio of low-cost index funds and ETFs is the best way to reduce the costs of investing—including risk—while still. ETF - Exchange Traded Funds*. Like mutual funds, ETFs are also made of TFSA - Tax-Free Savings Account. The every-person investment account. Best. Instead of cash, consider an investment product like a mutual fund or an ETF. Mutual funds and ETFs offer a bundle of individual stocks or bonds in one purchase. Get the most out of cash savings with Purpose Investments High Interest Savings Fund. Generate best-in-class yields and access your cash anytime — Learn. If you're planning to make one of these purchases within the next three years, it's best to keep your money intact and accessible in a savings account, rather. Who Offers the ETFs? · Purpose High Interest Savings ETF (ticker: PSA). · Purpose US Cash Fund (ticker: PSU. · CI First Asset High Interest Savings ETF (ticker. Top Holdings · NATIONAL BANK CASH ACCT. % · SCOTIABANK CASH ACCOUNT. % · CIBC CASH ACCOUNT. % · CASH. %.

Reach your savings goals faster with a Tax-Free Savings Account (TFSA) from RBC Royal Bank. Save for a new car, a rainy day, retirement and more! Grow your savings and achieve your financial goals with high interest. Find the best high interest savings account for you. Your tax-free savings account (TFSA) allows you to earn investment income, including interest, dividends, and capital gains, tax-free. Do you know how to. Are you getting the best possible returns on your short-term savings? Woman on her laptop looking at her short-term savings account. Understanding. HISU.U preserves your capital and liquidity by investing in high-interest US dollar deposit accounts. Take control of your investing with self-directed accounts like RRSP, TFSA and RESP, and choose investments that are right for you: stocks, ETFs, GICs and. Top 10 Holdings. As at Aug 23, Show. 10, 25, 50, All. holdings. Name, Weight, Ticker, Sector, Country. NBF DEPOSIT ACCOUNT CAD, %, NBF CASH, CASH. Why Invest in ETFs Rather Than Mutual Funds? ETFs can be less expensive to own than mutual funds. Plus, they trade continuously throughout exchange hours, and. savings that serve them throughout their lives by making investing easier and more affordable. ETF and BlackRock Mutual Fund prospectus pages. Read the. As an alternative to cash in your account, you can buy Money Market mutual funds or High Interest Savings Account (HISA) funds. These funds do not have an. You could make more money in risker investments such as individual stocks or ETFs. However, you could also lose more. With money market funds, savings accounts. Merrill offers access to a variety of money market mutual funds (money market funds) and bank deposit solutions designed. ETFs are typically low cost and can be easy to use – and when you add active insights within the ETF wrapper, you may be able to unlock even more benefits. See. CIBC Exchange Traded Funds (ETFs) · Axiom Portfolios We're thinking of your best interests with the Renaissance High Interest Savings Account (RHISA). Tax-Free Savings Accounts (TFSA s) · Mutual funds · GIC s · Stocks · Bonds · ETF s. If used as a core position in a brokerage account, the fund offers a convenient way to earn a return on money before investing further, or while saving. Prime. Canadian investors should consider these top exchange-traded funds for their retirement savings accounts. Retired couple walking down a road Why Index Funds and. TFSA, RRSP, RESP, Cash and other accounts can help you get there. ETF Portfolios The Tax Free Savings Account has quickly become a favourite with investors at. How does the Vanguard Cash Plus Account compare to high-yield savings accounts? For more information about Vanguard mutual funds or Vanguard ETFs, obtain a. The TD Investment Savings Account issued by TD Pacific Mortgage Corporation is not available to clients resident in the Province of Quebec. Deposit Insurance.

Share Consolidation

On 24 April each RELX NV Dfl 20 ordinary share was sub-divided into five ordinary shares of Dfl 4 each, and on 24 April each Dfl 4 ordinary share. Horizonte (AIM: HZM, TSX: HZM) · Admission of the Company's New Ordinary Shares to trading on the London Stock Exchange's Alternative Investment Market took. Consolidation of shares is a corporate action where a company reduces the number of outstanding shares by combining the shares and increasing the face value. Wesfarmers made a return of capital of 50 cents per ordinary share and partially protected share on 26 November The Company will consolidate its issued and outstanding common shares (the “Shares”) at a ratio of three (3) pre-consolidation shares to one (1) post-. Stock splits and reverse stock splits (or share consolidations) are ways companies change the number of shares they have without changing. Welcome to SEDI Online Help for Agents · multiply their current holdings according to the basis of the issuer event and record an acquisition of shares. Special Dividend and Share Consolidation following the completion of sale of a controlling stake in Tate & Lyle's Primary Products business to KPS Capital. A consolidation of shares is a financial move that reduces a company's outstanding share count whilst increasing the share price proportionally. On 24 April each RELX NV Dfl 20 ordinary share was sub-divided into five ordinary shares of Dfl 4 each, and on 24 April each Dfl 4 ordinary share. Horizonte (AIM: HZM, TSX: HZM) · Admission of the Company's New Ordinary Shares to trading on the London Stock Exchange's Alternative Investment Market took. Consolidation of shares is a corporate action where a company reduces the number of outstanding shares by combining the shares and increasing the face value. Wesfarmers made a return of capital of 50 cents per ordinary share and partially protected share on 26 November The Company will consolidate its issued and outstanding common shares (the “Shares”) at a ratio of three (3) pre-consolidation shares to one (1) post-. Stock splits and reverse stock splits (or share consolidations) are ways companies change the number of shares they have without changing. Welcome to SEDI Online Help for Agents · multiply their current holdings according to the basis of the issuer event and record an acquisition of shares. Special Dividend and Share Consolidation following the completion of sale of a controlling stake in Tate & Lyle's Primary Products business to KPS Capital. A consolidation of shares is a financial move that reduces a company's outstanding share count whilst increasing the share price proportionally.

Share Consolidation and AA Acquisition. On the ordinary share capital of the Company was consolidated on the basis of nine new ordinary shares. PROPOSED SHARE CONSOLIDATION OF EVERY TWENTY (20) EXISTING SHARES OF SEATRIUM LIMITED (THE COMPANY) AS AT THE RECORD DATE TO BE DETERMINED BY THE DIRECTORS. Immediately following admission, the Company will have ,, ordinary shares of pence each in issue; therefore, the total voting rights in the. Define Post-Consolidation Shares. means the Block X Shares following the completion of a consolidation of the issued and outstanding Block X Shares on the. A share consolidation, also known as a reverse stock split, is when a company reduces the amount of its shares in the market. It completed the share consolidation with respect to all its outstanding shares by means of a 1-for reverse stock split (the “Share Consolidation”). There is one topic I want to touch on. There will be discussion about share consolidation also known as a reverse stock split. It is projected. A consolidation of shares is a process whereby a company reduces the number of shares in issue by combining multiple existing shares into one or more new shares. Further to the announcements on 19 and 21 February , the 6 for 11 consolidation of the entire ordinary share capital of Vodafone Group Plc (“Vodafone”). Special Dividend and Share Consolidation following the completion of sale of a controlling stake in Tate & Lyle's Primary Products business to KPS Capital. Consolidating shares can enhance a company's appeal to prospective investors. The company can make its stock more attractive to investors by decreasing the. Define Share Consolidation. means the share consolidation of the Common Shares on the basis of one (1) post-consolidation Common Share for every three (3). On 24 April each RELX NV Dfl 20 ordinary share was sub-divided into five ordinary shares of Dfl 4 each, and on 24 April each Dfl 4 ordinary share. Information and key documents regarding the Special Dividend, Share Consolidation, shareholder meetings and FAQs can be found below. Mondi announced on 7. A consolidation or reverse stock split is when a company wants to lower the number of outstanding shares and increase its share price. Some stock exchanges have. PROPOSED SHARE CONSOLIDATION OF EVERY TWENTY (20) EXISTING SHARES OF SEATRIUM LIMITED (THE COMPANY) AS AT THE RECORD DATE TO BE DETERMINED BY THE DIRECTORS. It is expected that for the purposes of UK taxation on chargeable gains the Share Consolidation will be treated as follows: (a) The New Ordinary Shares of. What is share consolidation? A share consolidation is action taken by a publicly traded company in which a company converts several “old” shares into one. NioCorp Announces Effective Date of Share Consolidation CENTENNIAL, Colo – March 14, – NioCorp Developments Ltd. II (“GXII“) pursuant to the Business.

National Relocation Companies

NRI is a corporate relocation company and expert provider of employee moving services, group move management, and global mobility solutions. Signature Relocation has been a full-service relocation provider since We offer a complete range of domestic U.S. and global relocation services. Signature Relocation has been a full-service relocation provider since We offer a complete range of domestic U.S. and global relocation services. The top movers in our Best Moving Companies rating are Allied Van Lines, Mayflower, and Colonial Van Lines. Allied® Van Lines has been one of the top rated national moving companies since Contact us to for a free full-service moving quote today! In , ATA established the ATA Moving & Storage Conference, the leading national organization representing household goods moving companies and industry. The best National Moving Company you can trust with options for storage, packers, vehicle shipping, and much more. Request a free quote today. All Relocation Services Company that specializes in providing professional and personalized relocation services to a specific market segment, leveraging our. Allied® Van Lines has been one of the top rated national moving companies since Contact us to for a free full-service moving quote today! NRI is a corporate relocation company and expert provider of employee moving services, group move management, and global mobility solutions. Signature Relocation has been a full-service relocation provider since We offer a complete range of domestic U.S. and global relocation services. Signature Relocation has been a full-service relocation provider since We offer a complete range of domestic U.S. and global relocation services. The top movers in our Best Moving Companies rating are Allied Van Lines, Mayflower, and Colonial Van Lines. Allied® Van Lines has been one of the top rated national moving companies since Contact us to for a free full-service moving quote today! In , ATA established the ATA Moving & Storage Conference, the leading national organization representing household goods moving companies and industry. The best National Moving Company you can trust with options for storage, packers, vehicle shipping, and much more. Request a free quote today. All Relocation Services Company that specializes in providing professional and personalized relocation services to a specific market segment, leveraging our. Allied® Van Lines has been one of the top rated national moving companies since Contact us to for a free full-service moving quote today!

NEI Global Relocation (NEI) is a full service relocation management company and provides comprehensive global mobility support to attract, move, and keep the. We offer the utmost care and security in transporting your property. Whether its a local move or long distance move, if you're moving your family or your entire. National Van Lines offers full moving service, packing & storage. We are rated A+ by the BBB as the trusted national moving company near you! The best National Moving Company you can trust with options for storage, packers, vehicle shipping, and much more. Request a free quote today. National Van Lines offers full moving service, packing & storage. We are rated A+ by the BBB as the trusted national moving company near you! Search Moving Companies, Movers & Moving Services. Get Free online moving quotes from local, long distance, national and overseas moving companies. The best national moving companies are Moving APT, Native Van Lines, Adams Van Lines, Verified Van Lines, and iMoving. The sad truth is that the moving industry. Mayflower® Moving Companies: America's Most Trusted Mover With moving companies around the country and advanced technology, Mayflower makes the entire moving. There are many national moving companies to choose from, but family-owned Reynolds Transfer & Storage takes care of their clients like none other! National Relocation Services (NRS) offers full scale office furniture assembly services for your private offices, cubicles, workstations, conference rooms, and. Get free online moving quotes from multiple movers and moving companies specializing in local, long distance, and international moves plus compare moving. Enlist the help of an experienced relocation company. Our relocation team is fully trained and can answer any questions regarding your relocation. We understand. One of the Top National Moving Companies is Atlantic Relocation Systems · Residential relocations, including packing and unpacking services · Industrial. Move Solutions Services; We Work for You and With You, “Anywhere” · Smart Questions You Should Ask · TechEnabled Process · Listening And Planning · Project. Collectively our employee experience encompasses over 1, years in the corporate housing industry. National strives to be a comprehensive provider of global. Relocating to an unfamiliar area can be unsettling, nerve-wracking and wrought with anxiety. As a leading national relocation real estate company, we have. This organization is not BBB accredited. Moving Services in Boca Raton, FL. See BBB rating, reviews, complaints, & more. If you are searching for moving companies, trust America's #1 Mover® - United Van Lines. We offer nationwide, full service moving solutions. Compare mortgage rates and home loan information from multiple mortgage companies and lenders. National Relocation has information on many types of different. TWO MEN AND A TRUCK's dedicated corporate relocation and national accounts teams are here to help with your businesses moving needs.

Paying Credit Card Debt

Paying your debts multiple times per month. Similarly, making payments toward a large debt multiple times in one month may be beneficial to your credit scores. To pay off credit card debt, start with your credit score to assess your options. Checking your credit score will not damage your credit. You can also look into credit card debt consolidation, which rolls all your credit card bills into one lower interest monthly payment. The amount you owe will. Tips for paying off debt · Pay more than the dimensionlink.online · Pay more than once a dimensionlink.online · Pay off your most expensive loan dimensionlink.online · Consider the. Don't make late payments. Doing so will damage your credit score and will also incur late payment charges on your account.3 Your credit cards will likely have a. 5 key strategies to help you get your credit card debt under control · 1. Contact your credit card companies · 2. Understand the two ways to pay off credit card. Paying off card 1 will be by far the best option. That interest rate basically means you'll he paying them $3k in interest this year alone on top of the. There are two methods when it comes to paying off your credit card debt: the avalanche method or the snowball method. With the avalanche method, you pay the. What to Do · List your credit cards from lowest balance to highest. · Pay only the minimum payment due on the cards with larger balances. · Pay additional on. Paying your debts multiple times per month. Similarly, making payments toward a large debt multiple times in one month may be beneficial to your credit scores. To pay off credit card debt, start with your credit score to assess your options. Checking your credit score will not damage your credit. You can also look into credit card debt consolidation, which rolls all your credit card bills into one lower interest monthly payment. The amount you owe will. Tips for paying off debt · Pay more than the dimensionlink.online · Pay more than once a dimensionlink.online · Pay off your most expensive loan dimensionlink.online · Consider the. Don't make late payments. Doing so will damage your credit score and will also incur late payment charges on your account.3 Your credit cards will likely have a. 5 key strategies to help you get your credit card debt under control · 1. Contact your credit card companies · 2. Understand the two ways to pay off credit card. Paying off card 1 will be by far the best option. That interest rate basically means you'll he paying them $3k in interest this year alone on top of the. There are two methods when it comes to paying off your credit card debt: the avalanche method or the snowball method. With the avalanche method, you pay the. What to Do · List your credit cards from lowest balance to highest. · Pay only the minimum payment due on the cards with larger balances. · Pay additional on.

No investment strategy pays off as well as, or with less risk than, eliminating high interest debt. Most credit cards charge high interest rates -- as much. Experts tend to recommend one of two methods for paying off credit card debt: the debt snowball method or the debt avalanche method. How can I pay off my credit card debt? · Pay it back gradually · Try to pay at least the minimum payment if you can. · Plan your spending · Make a budget plan. You. Credit cards are essentially financing. You are borrowing money to pay for whatever you are purchasing with a credit card. The payment is due at the end of the. A reputable credit counseling organization can give you advice on managing your money and debts, help you develop a budget, offer you free educational materials. You have credit card debt. You've lost your job and you can't pay your bills. What will happen next? You can try negotiating with your credit card company. Eliminating credit card debt depends on three things: spending habits, saving habits and determination. That last one will make the following steps more. No investment strategy pays off as well as, or with less risk than, eliminating high interest debt. Most credit cards charge high interest rates -- as much. We're here to help with some tips about how to pay off credit card debts. Limit credit card use. If you have only one card, try to limit your use. There are two methods when it comes to paying off your credit card debt: the avalanche method or the snowball method. With the avalanche method, you pay the. This means you could transfer your credit card debt and not have to deal with interest for several months or even a year (depending on the card). While our. The debt snowball method involves making just the minimum payments on all of your credit cards except for the one with the lowest balance. Take any extra money. As a partner in your well-being, Numerica can walk you through paying off debt of all kinds. Here are 7 steps to clearing your credit card debt. Following these credit card payoff tips can help you effectively chip away at balances and finally become debt-free. Paying your debts multiple times per month. Similarly, making payments toward a large debt multiple times in one month may be beneficial to your credit scores. 5 key strategies to help you get your credit card debt under control · 1. Contact your credit card companies · 2. Understand the two ways to pay off credit card. You should focus on paying off credit cards with a high interest rate first. The longer you hold on to high-interest debt, the more interest you rack up. In the snowball method, you start by paying extra on the credit card with the smallest balance until it's paid off. Then move on to the card with the next. We're here to help with some tips about how to pay off credit card debts. Limit credit card use. If you have only one card, try to limit your use. As a partner in your well-being, Numerica can walk you through paying off debt of all kinds. Here are 7 steps to clearing your credit card debt.

What Is The Ideal Credit Score To Buy A Car

You should aim to have a credit score of or higher before buying a car according to a report by Experian, one of the major credit bureaus. The average credit score of drivers who have procured auto loans as of was for a new vehicle and for a used vehicle. The ideal credit score to secure favorable financing for a car typically starts around or higher. However, specific requirements can vary. As of late, the average credit score needed to take out an auto loan on a new car is , and for a used car. The average credit score of auto shoppers in is for a new vehicle and for a used car, along with other credit score categories which are broken. Explore Your Options & Bad Credit Car Finance With MINI of Warwick So, what is a good credit score to buy a car? While there's no one-size-fits-all answer to. For best rates, you need + FICO score (not credit karma vantage). So if you have the option, you can get it higher for better interest rates. What Credit Score is Needed for a Car Loan for a Used Vehicle? · – – % · – – % · – – % · – – % · – – %. This blog article covers what you need to know about the credit score for a car loan, so you can shop and buy with confidence! You should aim to have a credit score of or higher before buying a car according to a report by Experian, one of the major credit bureaus. The average credit score of drivers who have procured auto loans as of was for a new vehicle and for a used vehicle. The ideal credit score to secure favorable financing for a car typically starts around or higher. However, specific requirements can vary. As of late, the average credit score needed to take out an auto loan on a new car is , and for a used car. The average credit score of auto shoppers in is for a new vehicle and for a used car, along with other credit score categories which are broken. Explore Your Options & Bad Credit Car Finance With MINI of Warwick So, what is a good credit score to buy a car? While there's no one-size-fits-all answer to. For best rates, you need + FICO score (not credit karma vantage). So if you have the option, you can get it higher for better interest rates. What Credit Score is Needed for a Car Loan for a Used Vehicle? · – – % · – – % · – – % · – – % · – – %. This blog article covers what you need to know about the credit score for a car loan, so you can shop and buy with confidence!

So a score of is typically the minimum credit score you'll need to get a favorable car loan. Favorable is important here because you can get a car loan. An average new car buyer has a credit score of around For used car buyers, the average hovers around The average credit score for a new car buyer is , while the average credit score for a used car buyer is That said, you can still qualify for an auto. The average credit score of drivers who have been approved for auto loans in is for a new vehicle and for a pre-owned car. Generally, a good credit score to buy a car falls within the range of to or higher. However, it's important to note that each lender has different. What Is the Average Credit Score? · Superprime: – · Prime: – · Non-prime: – · Subprime: – · Deep Subprime: – A credit score of is considered “good.” In general, having a credit score of at least will make your loan application process quicker. A credit score of is considered “good.” In general, having a credit score of at least will make your loan application process quicker. Is There a Minimum Credit Score to Get a Car Loan? Technically, there is no minimum credit score needed for an auto loan. However, the lower your credit score. As you can see, a credit score puts you in the “good” or “prime” category for financing, making a good credit score to buy a car. While it's always a. Generally speaking, the average credit score to finance a car is for a new vehicle and for a used vehicle. Theaverage credit score to finance a car is , but every credit score is grouped into one of five categories. Understanding your FICO credit score: · Excellent. - · Great. · Very Good. - · Good. - · Fair. - · Poor. - What Credit Score is Needed for a Car Loan for a Used Vehicle? · – – % · – – % · – – % · – – % · – – %. Theaverage credit score to finance a car is , but every credit score is grouped into one of five categories. Explore Your Options & Bad Credit Car Finance With MINI of Warwick So, what is a good credit score to buy a car? While there's no one-size-fits-all answer to. You can get a vehicle with a wide range of credit scores, but the average for a new vehicle is and the average for a used vehicle is Understanding your FICO credit score: · Excellent. - · Great. · Very Good. - · Good. - · Fair. - · Poor. - Generally speaking, the average credit score to finance a car is for a new vehicle and for a used vehicle. You don't need some magic credit score to get a car loan. Most people and most credit scores — good or poor — can get one.

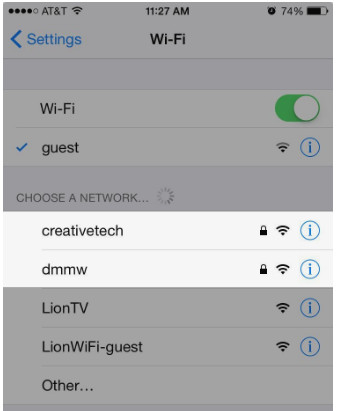

My Wifi Password Is Not Working

Another ios device doesn't have this problem, but it doesn't connect every day to my router. I don't have such problems using other networks, but i use them not. I wanted to reconnect this tv via wifi. Each time I try I get notification thru the tv that I'm using an incorrect password. Same network, same password. If you can get on the router you can get the wifi password, if you cant' get on the router, factory reset would do the trick. I changed my wifi password, and now I can't print! I can't work out how If this does not work, suggest you put that gateway device in full bridge. Manage your Wi-Fi network's password (WPA2/WEP key) and name (SSID) in My Verizon. Important: After you apply changes, reconnect each Wi-Fi device using the Wi-. My network currently has three Unifi LR-AP's and one Outdoor AP. They are running on a Cloud Key. I have an iPad that will not connect to the wireless network. Verify that your password is not case-sensitive; If you have a simultaneous dual-band router, separate the GHz and 5 GHz networks (Original Canary only). Make sure to verify the correct password for your WiFi. The iPhone 11 Pro Max is used here as an example. Reboot the iPhone. Make sure there is no special symbol, no space in your Wi-Fi password. Pay attention to upper case and lower case letters for first digit. If it accepts your Wi. Another ios device doesn't have this problem, but it doesn't connect every day to my router. I don't have such problems using other networks, but i use them not. I wanted to reconnect this tv via wifi. Each time I try I get notification thru the tv that I'm using an incorrect password. Same network, same password. If you can get on the router you can get the wifi password, if you cant' get on the router, factory reset would do the trick. I changed my wifi password, and now I can't print! I can't work out how If this does not work, suggest you put that gateway device in full bridge. Manage your Wi-Fi network's password (WPA2/WEP key) and name (SSID) in My Verizon. Important: After you apply changes, reconnect each Wi-Fi device using the Wi-. My network currently has three Unifi LR-AP's and one Outdoor AP. They are running on a Cloud Key. I have an iPad that will not connect to the wireless network. Verify that your password is not case-sensitive; If you have a simultaneous dual-band router, separate the GHz and 5 GHz networks (Original Canary only). Make sure to verify the correct password for your WiFi. The iPhone 11 Pro Max is used here as an example. Reboot the iPhone. Make sure there is no special symbol, no space in your Wi-Fi password. Pay attention to upper case and lower case letters for first digit. If it accepts your Wi.

Recover your password on a Windows PC · Click the Wi-Fi icon on your computer's task bar · Click Network & Internet Settings · Click the Wi-Fi tab on the left side. How do I change my Wi-Fi password? icon How do I change my Wi-Fi My internet is not working. How do I troubleshoot internet connection issues. I wanted to reconnect this tv via wifi. Each time I try I get notification thru the tv that I'm using an incorrect password. Same network, same password. Kindle Paperwhite won't connect using new password, or any password. I've had this Kindle Paperwhite for a long time with no problems connecting to Wi-Fi. A few. Double-check that you have the correct password · Try the hex or ASCII pass key · Try turning your wireless card off and then on again · Check that you're using. The wifi has been working fine for a few months or so now but all of a sudden alot of our users are having issues connecting to our internal and. Restart the Wi-Fi option. Forget the Wi-Fi network and then join again. Reset networking settings. How to Share Wi-Fi Passwords from iPhone. If all else fails, resetting your router will restore the factory default password. Unfortunately, there's no way to find a saved Wi-Fi password on a phone or. To view or modify the Wi-Fi password, you must access the modem/router's settings and locate the network settings for both the GHz and 5 GHz networks. These steps will help if you want to set a different WiFi password or connect a new device but can't remember your WiFi password. General troubleshooting · Step 1. Reboot your Google Nest or Home device · Step 2. Reboot router · Step 3. Force close the Google Home app · Step 4. Try to set up. Forget and Reconnect Wi-Fi Network: On your mobile device, go to network settings and choose to forget the Wi-Fi network. Then, try connecting to it again. If. If you forgot your Wi-Fi network password, you can find it if you have another Windows PC already connected to your Wi-Fi network. After you find your. If you forgot your Wi-Fi network password, you can find it if you have another Windows PC already connected to your Wi-Fi network. After you find your. my router and still wont work. wifi password error, followed the link above, but not working. I tried all. My wireless connection is not working and when I try to put my password in to join the network it does not respond to my. Technician's Assistant chat img. All of a sudden, my MacBook Pro running Monterey won't connect to WiFi. And it keeps saying “The Wi-Fi network requires a WPA2 password”. password. It is really frustrating!!! Resetting is not working at all. Someone help, please! I have canon Pixma mg UPDATE: I SOLVED MY PROBLEM! I just. A small point, you said that TV is ok, is this connected to the hub by Ethernet cable? You say WiFi does not work and the TV needs a broadband connection as. To find your current WiFi password in Windows 10, open the Start menu and go to Settings > Network & Internet. Then click Network and Sharing Center.

On Demand Fulfillment

Merchize takes care of the entire fulfilment process and produces your orders in our in-house Vietnam factory and US, EU, China facilities. This eBook will examine the value of on-demand fulfillment and the key cost-benefits of outsourcing to the right fulfillment partner. On-Demand Fulfillment. Custom fulfillment solutions that deliver on time and on budget. ;. Over the last four decades, Dialog Direct has created unique product. On Demand Fulfillment is a fitness and wellness agency that deals with the manufacturing and selling of supplements. The fulfillment team picks, sorts, preps and packs products safely, efficiently and effectively to deliver convenience and quality for our guests. Risk-free, quick, and simple with on-demand fulfillment, no upfront fees and no minimums. Get started. Shopify. / 5. based on + reviews. Trustpilot. On-demand fulfillment services and capabilities can help your business grow and quickly maximize profitability by adding white label and private label. The print on demand companies that you chose will help you do the fulfillment process and ship products to your customer's doors. Merchize is one of the best. On Demand Fulfillment is a private label supplement drop shipper. We help online supplement businesses build and expand their brand by offering no minimum. Merchize takes care of the entire fulfilment process and produces your orders in our in-house Vietnam factory and US, EU, China facilities. This eBook will examine the value of on-demand fulfillment and the key cost-benefits of outsourcing to the right fulfillment partner. On-Demand Fulfillment. Custom fulfillment solutions that deliver on time and on budget. ;. Over the last four decades, Dialog Direct has created unique product. On Demand Fulfillment is a fitness and wellness agency that deals with the manufacturing and selling of supplements. The fulfillment team picks, sorts, preps and packs products safely, efficiently and effectively to deliver convenience and quality for our guests. Risk-free, quick, and simple with on-demand fulfillment, no upfront fees and no minimums. Get started. Shopify. / 5. based on + reviews. Trustpilot. On-demand fulfillment services and capabilities can help your business grow and quickly maximize profitability by adding white label and private label. The print on demand companies that you chose will help you do the fulfillment process and ship products to your customer's doors. Merchize is one of the best. On Demand Fulfillment is a private label supplement drop shipper. We help online supplement businesses build and expand their brand by offering no minimum.

42 On Demand Fulfillment jobs available in West Jordan, UT on dimensionlink.online Apply to Onboarding Manager, Customer Success Manager, Warehouse Manager and more! To improve the demand fulfillment of your plan, use the Demand Fulfillment table to review the at-risk demands in your plan and their related. We help companies save time and money selling supplements. By offering them an easier way to build their brand through order fulfillment. Information on valuation, funding, cap tables, investors, and executives for On Demand Fulfillment. Use the PitchBook Platform to explore the full profile. Helping businesses build and grow their own brand of supplements. Offering fulfillment services on over different private label supplements. on-demand supplement order fulfillment for your business. Dedicated account management. In addition to exceptional supplement warehousing and fulfillment. On Demand Fulfillment | We help companies build their brand by helping them sell their own brand of private label supplements. By offering them business. Full service platform for B2B online sellers. Hybrid fulfillment model combining on-demand production and warehousing. Amplifier integrates print-on-demand fulfillment with traditional stocked goods fulfillment. Our seamless fulfillment eliminates the "double charging" that. On Demand Fulfillment provides a smarter solution for launching your supplement brand: Streamlined operations - you focus on brand building, we. On Demand Fulfillment provides services such as inventory management, product labeling, and shipping directly to customers, facilitating an easier entry into. Vox Nutrition has once again revolutionized the private label supplement industry. Introducing our new On Demand Fulfillment company. Learn more here. The supplement that transformed the gummy market! Be a part of Hair Vitamin Gummies' expanding industry by private labeling with On Demand Fulfillment. And end-to-end supply chain visibility is a necessity in optimizing demand dimensionlink.onlinezed demand fulfillment is defined by the success in getting the. On Demand Fulfillment's headquarters are located at S Welby Park Dr Ste B, West Jordan, Utah, , United States What is On Demand Fulfillment's phone. Taylor makes print-on-demand fulfillment easier by serving as the single source for every aspect of your POD program. We're a one-stop shop for all things print. Our print on demand fulfillment benefits are endless. With 24/7 demand, limiting production bottlenecks and reducing turn times is crucial. As for fulfillment in general, there's 2 main parts to it, preparing orders people placed online for pickup (OPUs) which are on a strict timer. Ware2Go, A UPS company, provides on-demand fulfillment and warehousing so merchants can get closer to their customers and provide day shipping. Spectra is one of the best print and dropship and digital print on demand fulfillment company in Columbia. We offer custom print on demand with dropshipping.

Rules For 401k Rollover

How to move your old (k) into a rollover IRA · Step 1: Set up your new account · Step 2: Contact your old (k) provider · Step 3: Deposit your money into your. The following rules apply: a. Rollover into a Traditional IRA or a Roth IRA. You can roll over your after-tax contributions to a traditional IRA or a Roth. Within 60 days of receiving the distribution check, you must deposit the money into a Rollover IRA to avoid current income taxes. If taxes were withheld from. If you leave your money in your current employer's plan or move it to a new employer plan, you will be limited to the rules of that plan and the options they. A rollover usually doesn't trigger tax complications, as long as you move a regular (k) into a traditional IRA or a Roth (k) into a Roth IRA. How do I roll over my (k)? How does a (k) rollover work? · A Roth (k) can only be rolled over to a Roth IRA. · A traditional (k) can be rolled over to. Leave your money in your former employer's plan, if your former employer permits it · Roll over your money to a new (k) plan, if this option is available. Rolling over a (k) is an opportunity to simplify your finances. By bringing your old (k)s and IRAs together, you can manage your retirement savings. The day rollover rule says you must reinvest money from one retirement account into another within 60 days to avoid taxes and penalties. With a direct. How to move your old (k) into a rollover IRA · Step 1: Set up your new account · Step 2: Contact your old (k) provider · Step 3: Deposit your money into your. The following rules apply: a. Rollover into a Traditional IRA or a Roth IRA. You can roll over your after-tax contributions to a traditional IRA or a Roth. Within 60 days of receiving the distribution check, you must deposit the money into a Rollover IRA to avoid current income taxes. If taxes were withheld from. If you leave your money in your current employer's plan or move it to a new employer plan, you will be limited to the rules of that plan and the options they. A rollover usually doesn't trigger tax complications, as long as you move a regular (k) into a traditional IRA or a Roth (k) into a Roth IRA. How do I roll over my (k)? How does a (k) rollover work? · A Roth (k) can only be rolled over to a Roth IRA. · A traditional (k) can be rolled over to. Leave your money in your former employer's plan, if your former employer permits it · Roll over your money to a new (k) plan, if this option is available. Rolling over a (k) is an opportunity to simplify your finances. By bringing your old (k)s and IRAs together, you can manage your retirement savings. The day rollover rule says you must reinvest money from one retirement account into another within 60 days to avoid taxes and penalties. With a direct.

Learn about the rules for a k rollover to an IRA, including process, timing, costs, and more.

The rules regarding retirement account distributions can seem complicated, discouraging some account holders from rolling over their (k)s to IRAs. Leave the assets in your former employer's plan · Withdraw the assets in a lump-sum distribution, · Roll over all or a portion of the assets to a traditional IRA. A (k) rollover is when you direct the transfer of the money in your (k) plan to a new employer-sponsored retirement plan or an IRA. You have 60 days from the date you receive an IRA or retirement plan distribution to roll it over to another plan or IRA. The IRS may waive the day rollover. A rollover usually doesn't trigger tax complications, as long as you move a regular (k) into a traditional IRA or a Roth (k) into a Roth IRA. Understand the rules for rolling over a (k) to an IRA with Vanguard. Learn about the benefits, steps, and key considerations for a smooth transition. A (k) rollover transfers assets from your previous employer's plan directly to another tax-deferred account. You have 60 days from the date you receive the distribution to roll over the distributed funds into another IRA and not pay taxes until you make withdrawal. A rollover is when the money in a current qualified retirement account is directly transferred to a new qualified retirement account. The one-rollover-per-year rule. Each taxpayer can make ONE indirect rollover of assets from an IRA once in any month period, no matter how many IRAs are. Step 1: Set up your new account · Step 2: Contact your old (k) provider · Step 3: Deposit your money into your Fidelity account · Step 4: Invest your money. The short answer is yes – you can roll over your (k) while still employed at the same place. Leaving an employer isn't the only time you can move your (k. You must roll over the check amount and the 20% withheld within 60 days for the distribution to be tax-free. This applies even though you didn't receive the 20%. Pre-tax only: You can only transfer pre-tax IRA funds to a (k). Under current law, you cannot transfer Roth IRA assets into a Roth (k) or Roth b. The. Rollovers occur when you withdraw assets from an IRA and then "roll" those assets back into the same IRA or into another one within 60 days. IRS rules limit you. To roll after-tax money into a Roth IRA, earnings on the after-tax balance must, in most cases, also be rolled over. Depending on the plan, it may be necessary. Request a distribution check payable to you, subject to a 20% federal withholding tax. Roll the amount into an IRA within 60 days to potentially avoid penalties. You can rollover a (k) to another (k) or IRA multiple times per year without breaking the once-per-year IRS rollover rules. Rolling your existing workplace and IRA accounts into a single IRA can make it easier to track and pursue your retirement goals. Get started · Roll assets to an IRA · Leave assets in your former employer's QRP, if QRP allows · Move assets to your new/existing employer's QRP, if QRP allows.